Nvidia Surpasses Apple to Become Most Valuable Company Amid AI Boom

Nvidia Becomes the World’s Most Valuable Company

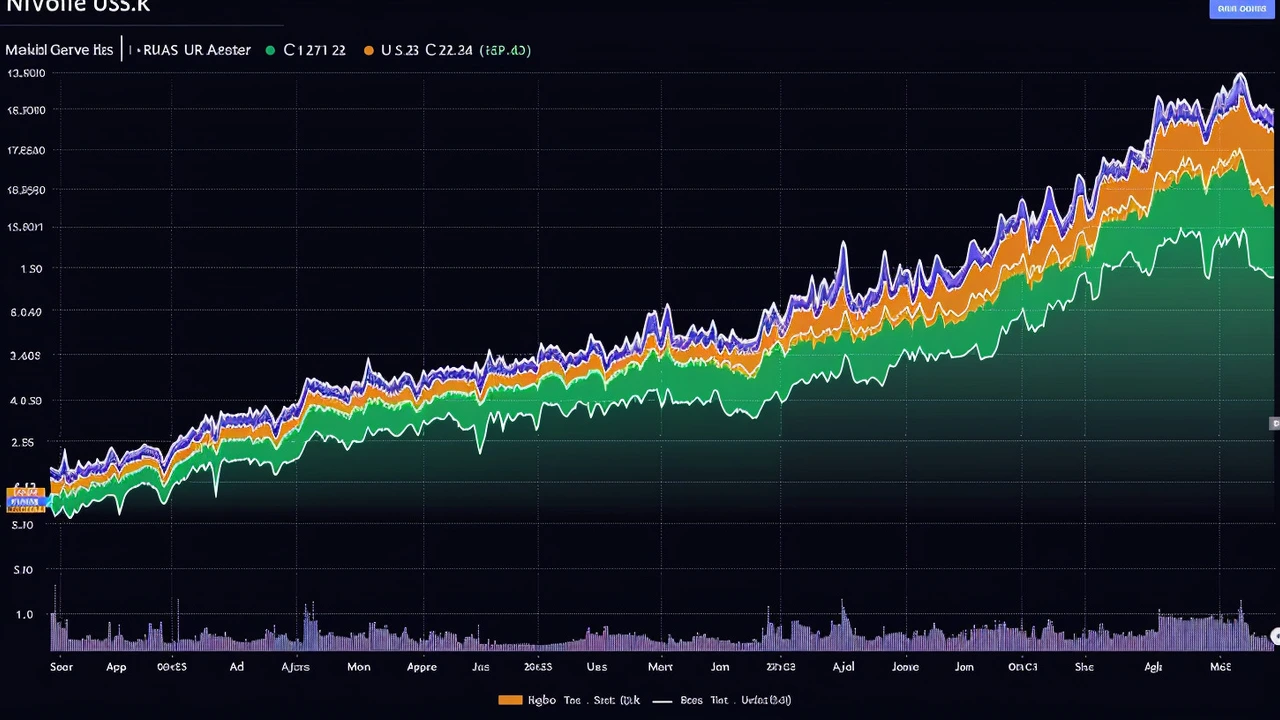

In a landmark event in the technology industry, Nvidia has overtaken Apple to become the most valuable company in the world. This monumental change is driven by Nvidia's pivotal role in the rapidly expanding artificial intelligence (AI) sector. With Nvidia's market capitalization reaching an astounding $2.5 trillion, the company has edged out Apple, which trails with a market valuation of approximately $2.3 trillion.

A Historic Milestone

This recent development underscores a significant shift in the landscape of the technology sector. Nvidia's impressive valuation can be largely attributed to its strategic focus on AI, an area where it has emerged as a key player. The demand for AI-powered technologies, such as those used in gaming, data centers, and autonomous vehicles, has seen a meteoric rise. Nvidia's technology, particularly its state-of-the-art graphics processing units (GPUs), plays a critical role in these cutting-edge applications.

The Role of Artificial Intelligence

Artificial intelligence has become one of the most sought-after technologies across various industries. From enhancing video gaming experiences to enabling self-driving cars, AI is transforming the way we interact with the world. Nvidia's expertise in this area has catapulted it to the forefront of technological innovation. Their GPUs are integral to training AI models, making them indispensable to companies and researchers working in AI.

The AI boom has been a significant growth driver for Nvidia. As companies and industries worldwide invest heavily in AI infrastructure, Nvidia's advanced processors are in high demand. The company's stock has experienced a substantial surge in recent months, reflecting investor confidence in its robust business model and future growth prospects.

Apple's Decline Amid Market Changes

In contrast, Apple has faced headwinds in recent times. Concerns about the slowing growth of the global smartphone market have weighed heavily on its stock. As a pioneer in the smartphone industry, Apple has enjoyed unparalleled success for many years. However, the market has become saturated, and the competition has intensified. As a result, Apple's market value has seen a decline, contributing to its slip from the top position.

Moreover, Apple’s recent product launches and innovations have not brought the same level of excitement and consumer demand as seen in previous years. While the company continues to maintain a loyal customer base, the pace of growth has decelerated. Investors have expressed concerns about whether Apple can sustain its market dominance amid these challenges.

Nvidia's Strategic Focus

Nvidia's rise to the top is a testament to its strategic focus and investment in future technologies. The company has consistently pushed the boundaries of what is possible with AI, making remarkable strides in areas like deep learning and neural networks. These advancements have not only driven Nvidia's revenue growth but have also positioned it as a leader in a transformative sector.

The company has also expanded its reach into other areas such as data centers and cloud computing, sectors that are experiencing rapid growth. Nvidia's GPUs are used to power data processing in some of the largest data centers around the world, providing the computational power required for large-scale AI applications. This diversification has further bolstered Nvidia's market position.

Market Dynamics and Future Prospects

The elevation of Nvidia to the top spot highlights the shifting dynamics in the technology sector. As AI and related technologies gain prominence, companies that are at the forefront of these advancements are attracting investor attention and commanding higher market valuations. The focus is clearly shifting towards companies that can drive innovation and deliver cutting-edge solutions in emerging tech fields.

Looking forward, the competition in the AI sector is expected to intensify, with numerous players vying for a share of this rapidly growing market. Nvidia’s continued success will depend on its ability to maintain its technological edge and adapt to the evolving landscape. The company’s strategic investments in research and development, as well as its partnerships with leading organizations, will be crucial in sustaining its leadership position.

Conclusion

Nvidia's ascendance as the most valuable company in the world marks a new era in the technology industry. The rise of AI, and Nvidia's pivotal role in this revolution, has reshaped market dynamics and investment priorities. As the technology landscape continues to evolve, the focus will increasingly be on companies that are driving innovation and capturing the opportunities presented by emerging technologies.

While Apple remains a formidable player with a strong brand and loyal customer base, the challenges it faces in maintaining its growth trajectory cannot be overlooked. The competition is fierce, and the landscape is ever-changing. The battle for market dominance is far from over, and the coming years will undoubtedly bring new developments and shifts in the rankings. For now, Nvidia’s achievement stands as a testament to the transformative power of AI and the company's strategic vision in leading the charge towards this exciting future.

Key Takeaways

- Nvidia has surpassed Apple to become the world's most valuable company, driven by its leading role in the AI sector.

- The demand for AI technologies, particularly in gaming and autonomous vehicles, has fueled Nvidia’s rapid growth and market valuation.

- Apple’s market value has declined due to concerns over global smartphone market growth and increased competition.

- The tech landscape is shifting towards companies that are innovating in emerging technologies like AI.

Ghanshyam Shinde

June 6, 2024 AT 19:43So Nvidia finally beat Apple? Who would've thought the chip makers would outgrow the phone king. Guess the AI hype is just a fancy marketing gimmick.

Charlotte Louise Brazier

June 10, 2024 AT 07:03While Nvidia's rise is impressive, it's crucial we remember that innovation thrives on competition. Apple still pushes design and privacy standards that benefit everyone.

SAI JENA

June 13, 2024 AT 18:23The overtaking of Apple by Nvidia signifies a paradigm shift in market valuations, driven predominantly by AI integration within various sectors. This development underscores the strategic importance of GPU technologies.

Donny Evason

June 17, 2024 AT 05:43From a philosophical standpoint, the ascendancy of a semiconductor firm over a consumer electronics titan reflects society's evolving valuation of computational power over mere consumer appeal. It challenges our notions of what constitutes true technological leadership.

Hariom Kumar

June 20, 2024 AT 17:03Wow! Nvidia's boom is crazy 🚀! Apple's slowdown feels like watching a giant sloth. 😅

Phillip Cullinane

June 24, 2024 AT 04:23The recent market-cap surge of Nvidia to $2.5 trillion encapsulates a confluence of macro‑economic factors, supply‑chain optimizations, and a relentless push toward AI‑centric compute workloads. Their latest Hopper architecture delivers unprecedented tensor‑core density, enabling deep‑learning training cycles that were previously infeasible. By capturing a growing slice of the hyperscale data‑center market, they have effectively embedded themselves into the fabric of cloud infrastructure. Moreover, the strategic acquisition of Arm, though still pending regulatory approval, signals a vertical integration aimed at harmonizing CPU‑GPU communication pathways. This move could significantly reduce latency in edge‑AI deployments, delivering a competitive moat. Concurrently, their gaming segment remains robust, with the RTX 40 series achieving record‑breaking sales, thereby cross‑pollinating revenue streams. Partnerships with automotive OEMs for autonomous‑driving platforms further diversify their addressable market. The synergy between software stacks like CUDA, cuDNN, and emerging open‑source frameworks fosters a developer ecosystem that locks in long‑term usage. Financially, their operating margin expansion outpaces industry averages, reflecting disciplined cost management. Analysts note a price‑to‑earnings multiple that, while lofty, is justified by projected cash‑flow trajectories. However, one must remain vigilant about potential headwinds, including geopolitical tensions affecting chip‑fab capacity and the looming threat of quantum‑computing disruptions. In sum, Nvidia's ascendancy is not merely a fleeting hype episode but a structural realignment of technological value creation.

Janie Siernos

June 27, 2024 AT 15:43It's disheartening to witness a company that once symbolized creative simplicity being overshadowed by a corporate behemoth focused solely on profit.

joy mukherjee

July 1, 2024 AT 03:03I get why people are excited about AI, but let's not write off Apple entirely-it still powers millions' daily lives.

Rob Chapman

July 4, 2024 AT 14:23Nvidia's GPUs are killing it in data centers.

Delaney Lynch

July 8, 2024 AT 01:43Interesting! Does this mean AI startups will hop onto Nvidia's platform even more??

Nicholas Mangraviti

July 11, 2024 AT 13:03Apple needs new growth drivers.

Jared Greenwood

July 15, 2024 AT 00:23This is proof that American chip making leads the world!

Sally Sparrow

July 18, 2024 AT 11:43Nvidia's surge is nothing but a bubble inflated by hype; soon it'll crash.

Eric Yee

July 21, 2024 AT 23:03maybe but the market loves tech momentum right now

Sohila Sandher

July 25, 2024 AT 10:23i think both companies have their strong points yeah

Anthony Morgano

July 28, 2024 AT 21:43Haha true! Nvidia's fire 🔥

Holly B.

August 1, 2024 AT 09:03Indeed Nvidia's valuation reflects broader industry trends

Lauren Markovic

August 4, 2024 AT 20:23Don't forget, Apple's services revenue still grows, balancing the scales 😊

Kathryn Susan Jenifer

August 8, 2024 AT 07:43Oh wow, so now Nvidia's the king of the hill? What a groundbreaking revelation!

Jordan Bowens

August 11, 2024 AT 19:03Just another tech hype cycle.